If you own rental real estate, the government is thinking about you…and not in a good way. The Government Accountability Office reported that 53% of taxpayers with rental real estate misreport when they file their tax returns. That means many property owners overestimated real estate tax loss. The bottom line is that owning rental real estate is now an audit flag.

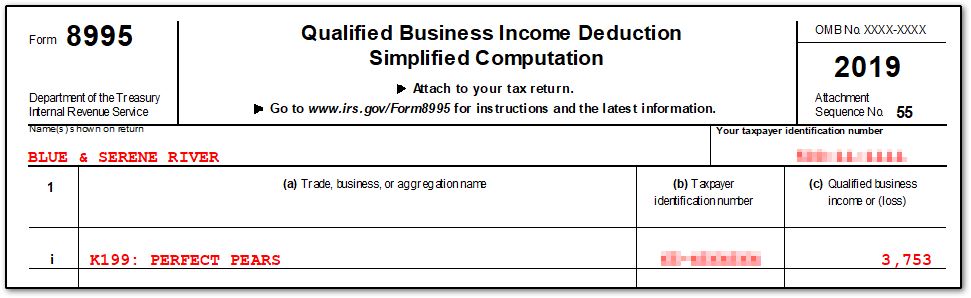

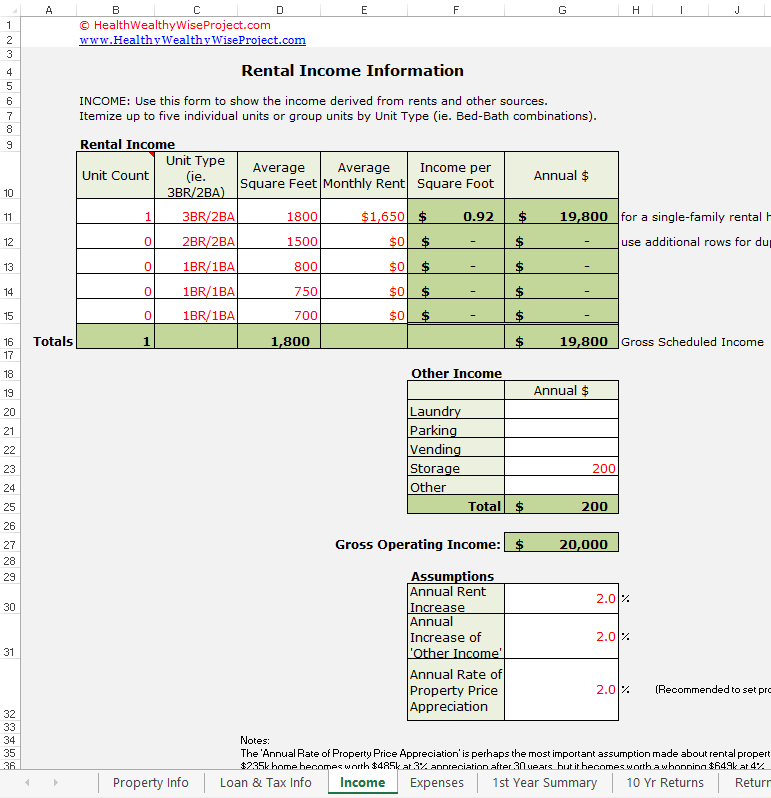

Irs Loss From Rental Property Income Calculator

These inflated tax losses cost the Treasury over $12 billion. Well the Government just called…and they want their money. As a result, the Treasury Administration revamped how they audit returns with rental real estate. That means more audits, and if you are one of the lucky ones who fall under their stare you're going to have to come up with a great deal more substantiation when you submit your return.

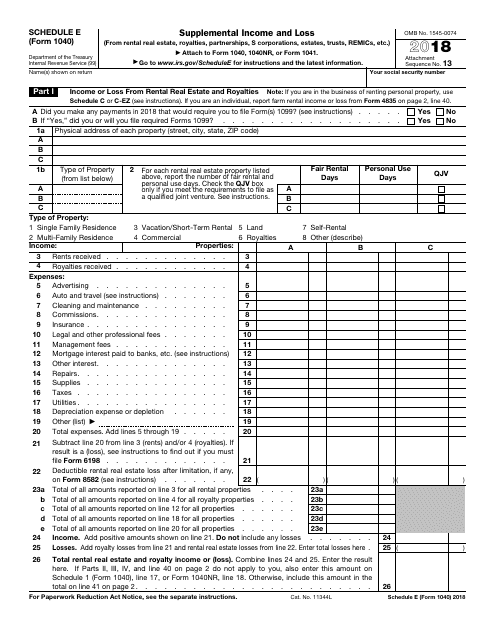

Income or Loss From Rental Real Estate and Royalties. Note: If you are in the business of renting personal property, use. See instructions. If you are an individual, report farm rental income or loss. The Government Accountability Office reported that 53% of taxpayers with rental real estate misreport when they file their tax returns. That means many property owners overestimated real estate tax loss. The bottom line is that owning rental real estate is now an audit flag. These inflated tax losses cost the Treasury over $12 billion.

If you filed a return more than three years ago, no worries. You're shielded by the three-year look-back. If you filed a return after that, beware and get ready.

Who should be most concerned?

The higher the marginal tax bracket you find yourself in, the greater the chances are that you'll be audited. That's because the Treasury nets a lot more when they disallow an expense at the 35% bracket than at the 10% bracket.

Another group of people who should worry about this are those who don't keep meticulous records. As I said, you're going to have to report more data. You need to report the type of property (condo, single-family home, multi-family or commercial).

How to Avoid an IRS Audit

You should keep records and be able to substantiate the number of days the property was rented versus occupied by you. If you use the rental yourself for more than 14 days in a year (or 10% of the days others rented it at fair market value) you should limit your deductions to mortgage interest, taxes and some losses plus direct expenses like advertising.

You can't use depreciation to create losses other than to offset rental income. You can carry these losses forward, but they are probably going to be the #1 target in an audit.

Now, if you claim to be a real estate professional, you might get an exemption to these limits, but you'll find yourself under the Treasury's microscope. To qualify as a real estate professional, you have to spend more than 50% of your time and at least 750 hours during the year on your rental property empire. If you don't qualify, the maximum loss you can claim in any one year is $25,000.

If you aren't a real estate professional, you probably have unallowed passive losses. That being the case, the Treasury may require you to submit Form 8582. This is going to make it easier for them to audit you. Even though these new rules are engineered to lasso the tax cheats, it's going to make it harder for everyone.

To summarize, keep meticulous records. Be squeaky clean if you are in a higher tax bracket, and don't be too aggressive. The kids in DC are watching.

Other Resources:

Home owners renting out their property and real estate investors alike are often faced with a unique dilemma in financial difficulties: should they continue to manage their properties or simply sell them at a loss?

But that dilemma becomes even more pertinent if the property in question is a rental property. For one, some think that rentals are supposed to be a fool-proof investment. At least, in theory. But there's an entire host of potential issues homeowners have to confront with a rental property. Screening tenants. Leases. Property maintenance. Even the threat of having to legally evict a tenant. Sometimes, it can be more hassle than it's actually worth.

Especially if you're in a down market. But the sale of rental property at a loss isn't just about losing an investment or your legal liabilities as a homeowner. There's also some advantages to selling rental property at a loss: tax implications, to be more precise.

When Is Selling Rental Property Actually A Loss?

Whether or not a rental property is viewed as a tax gain or a tax loss is generally based on three specific factors:

- Your initial investment when you first purchased your home.

- The cost of any improvements or renovations you may have made.

- Any depreciation deductions you're claiming on your income taxes.

If the cost of your deductions exceed that actual cost of your improvements and the value of your home has actually depreciated, it's claimable as a Section 1231 tax loss as business property—provided you've held the property for at least a year. There's one exception to this: a like-kind exchange.

A Section 1031 like-kind exchange occurs when you acquire one property of equal value in exchange, typically for tax deferral purposes. However, if the property you received in a like-kind exchange happens to be the rental property you plan on selling, IRS law requires you to transfer your existing tax basis to the new property, And if your tax basis is actually larger than the loss you're claiming, it will be considered a tax gain.

Why Should You Claim Rental Property As A Tax Loss?

Claiming rental property on your income taxes can be considered business property, even if you're not officially registered as a small business in the state of Utah. This allows you to include not only any losses you may have incurred from the depreciation of your home value, but also necessary home repairs, insurance, loan interest and even the cost of new appliances.

What's more, if the loss you're reporting is large enough to reduce your income to zero for two years or more, you can actually qualify your rental property as a net operating loss. You can recover most of your previous years losses simply by amending your returns to offset the previous taxable income for those years and ultimately ease the burden of selling your rental property.

Note that eligibility for claiming a loss on your home is waived if the property depreciated in value prior to converting it to a rental property.

Can I Claim My Personal Residence As Rental Property?

Converting a property from a rental back to your primary residence disposes you of your right to claim it as an income source and subsequently cannot be claimed as a section 1231 tax loss. However, you may be able to escape taxation of up to $250,000 ($500,000 for certain married couples filing joint returns) of gain on the sale of your home if you've used your residence for at least two out of five years preceding the sale of your home.

Irs Loss From Rental Property Income Limits

Fair Market Value And Selling Your Rental Property

If you're selling your rental property at a gain the tax basis consists of the original cost plus any amounts paid for improvements (not repairs), minus your depreciation deduction. If you're selling your rental property at a loss, however, the starting point for the basis is the remainder of the value of your property at the time it was converted from personal to rental property. You may, however, be eligible for a $250,000 tax gain exclusion if you've rented your property for three years or less prior to its sale. Speak with a trusted tax professional for more information.

What If I Need To Sell My Rental Property Immediately?

It's actually a fairly common practice to sell a rental property at short notice in Utah, even if you still have tenants with an active lease agreement. Utah law requires at least a 15 day notice to vacate if there is no set end date contained in a tenant-at-will lease, or a 5 day notice of tenancy at will if there is no rental agreement or if one has expired and you don't plan on renewing.

But if you're trying to sell a rental property at a loss only to discover your tax basis is larger than you expected, it might take you well over three months to find a qualified buyer. In the meantime? You still have to deal with no small share of headaches as a landlord. If you're looking to sell your home immediately in Utah, why not ask us for help at Gary Buys Houses? We've been helping rental property owners get the best estimate for their properties quickly, conveniently and fairly. We'll even help you find a qualified tax professional to help you claim the optimal deductions on your return!

When Is Selling Rental Property Actually A Loss?

Whether or not a rental property is viewed as a tax gain or a tax loss is generally based on three specific factors:

- Your initial investment when you first purchased your home.

- The cost of any improvements or renovations you may have made.

- Any depreciation deductions you're claiming on your income taxes.

If the cost of your deductions exceed that actual cost of your improvements and the value of your home has actually depreciated, it's claimable as a Section 1231 tax loss as business property—provided you've held the property for at least a year. There's one exception to this: a like-kind exchange.

A Section 1031 like-kind exchange occurs when you acquire one property of equal value in exchange, typically for tax deferral purposes. However, if the property you received in a like-kind exchange happens to be the rental property you plan on selling, IRS law requires you to transfer your existing tax basis to the new property, And if your tax basis is actually larger than the loss you're claiming, it will be considered a tax gain.

Why Should You Claim Rental Property As A Tax Loss?

Claiming rental property on your income taxes can be considered business property, even if you're not officially registered as a small business in the state of Utah. This allows you to include not only any losses you may have incurred from the depreciation of your home value, but also necessary home repairs, insurance, loan interest and even the cost of new appliances.

What's more, if the loss you're reporting is large enough to reduce your income to zero for two years or more, you can actually qualify your rental property as a net operating loss. You can recover most of your previous years losses simply by amending your returns to offset the previous taxable income for those years and ultimately ease the burden of selling your rental property.

Note that eligibility for claiming a loss on your home is waived if the property depreciated in value prior to converting it to a rental property.

Can I Claim My Personal Residence As Rental Property?

Converting a property from a rental back to your primary residence disposes you of your right to claim it as an income source and subsequently cannot be claimed as a section 1231 tax loss. However, you may be able to escape taxation of up to $250,000 ($500,000 for certain married couples filing joint returns) of gain on the sale of your home if you've used your residence for at least two out of five years preceding the sale of your home.

Irs Loss From Rental Property Income Limits

Fair Market Value And Selling Your Rental Property

If you're selling your rental property at a gain the tax basis consists of the original cost plus any amounts paid for improvements (not repairs), minus your depreciation deduction. If you're selling your rental property at a loss, however, the starting point for the basis is the remainder of the value of your property at the time it was converted from personal to rental property. You may, however, be eligible for a $250,000 tax gain exclusion if you've rented your property for three years or less prior to its sale. Speak with a trusted tax professional for more information.

What If I Need To Sell My Rental Property Immediately?

It's actually a fairly common practice to sell a rental property at short notice in Utah, even if you still have tenants with an active lease agreement. Utah law requires at least a 15 day notice to vacate if there is no set end date contained in a tenant-at-will lease, or a 5 day notice of tenancy at will if there is no rental agreement or if one has expired and you don't plan on renewing.

But if you're trying to sell a rental property at a loss only to discover your tax basis is larger than you expected, it might take you well over three months to find a qualified buyer. In the meantime? You still have to deal with no small share of headaches as a landlord. If you're looking to sell your home immediately in Utah, why not ask us for help at Gary Buys Houses? We've been helping rental property owners get the best estimate for their properties quickly, conveniently and fairly. We'll even help you find a qualified tax professional to help you claim the optimal deductions on your return!

Sometimes, rental properties are unquestionably fool proof. Other times, you really aren't certain what you'll get into until it happens. Like everything in life, it all depends on circumstances. Just keep in mind that a loss can sometimes be more of an advantage than you could have ever expected.